This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. The year-over-year growth formula is one of the most reliable ways of tracking your long-term growth. When you know where your business stands, you can invest your time in solving the problem—or getting even better. Since industries can differ from each other rather significantly, Alpha Lumber should only compare itself to other lumber companies.

Great! The Financial Professional Will Get Back To You Soon.

This being said, in order to best monitor your business finances, accounting, and bookkeeping, we’d recommend investing in robust accounting software, like QuickBooks, for example. With an intuitive accounting platform, you’ll be able to more easily how do i request prior year federal tax returns track your expenses, invoices, and customer payments—making calculating and tracking your accounts receivable turnover ratio even simpler as well. If Alpha Lumber’s turnover ratio is high, it may be cause for celebration, but don’t stop there.

What Is the Accounts Receivable Turnover Formula?

- Use this accounts receivable turnover calculator to quickly determine how many times your company collects its average accounts receivable in a year.

- A company should consider collecting on excessively old account receivable that are tying up capital, if their turnover ratio low.

- A higher turnover ratio suggests better credit management and a lower risk of default, while a declining ratio may raise concerns about the company’s ability to collect payments in a timely manner.

- This figure should include your total credit sales, minus any returns or allowances.

An average for your accounts receivable can be calculated by adding the value of the accounts receivable at the beginning and end of the accounting period and dividing it by two. A higher turnover ratio means you don’t have outstanding receivables for long. Your customers pay quickly or on time, and outstanding invoices aren’t hurting your cash flow.

Tips to Improve Your Accounts Receivable Turnover Ratio

We’ll do a calculation using a fictional company’s financial records for a period of January 1 to December 31. When inputting your own data, feel free to use whatever timeline you prefer. Further, if your business is cyclical, your ratio may be skewed simply by the start and endpoint of your accounts receivable average.

This fluctuation can distort the ratio if a non-annualized net turnover is used for comparison. An additional consideration is the use of baseline figures for the ratio calculation. Some companies use total sales instead of net sales, the result is an inflated ratio calculation.

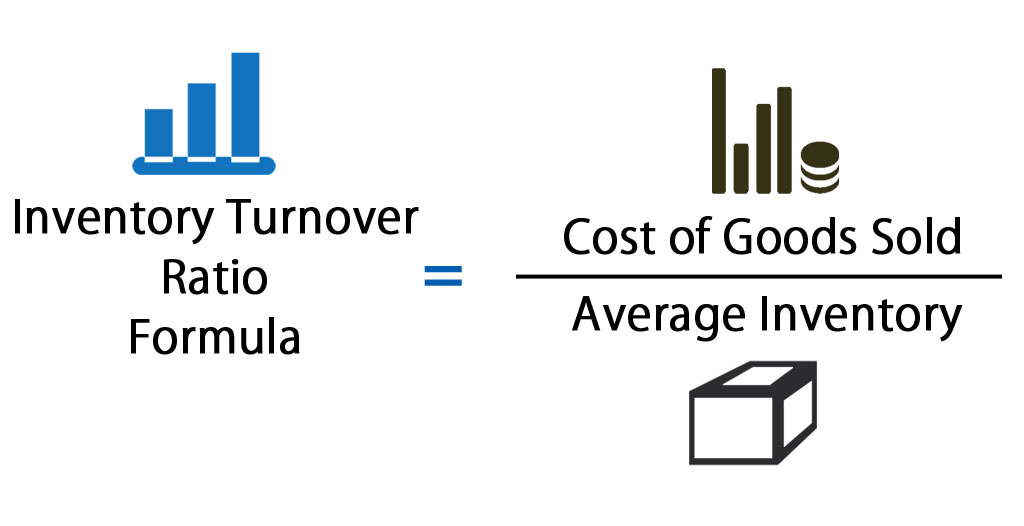

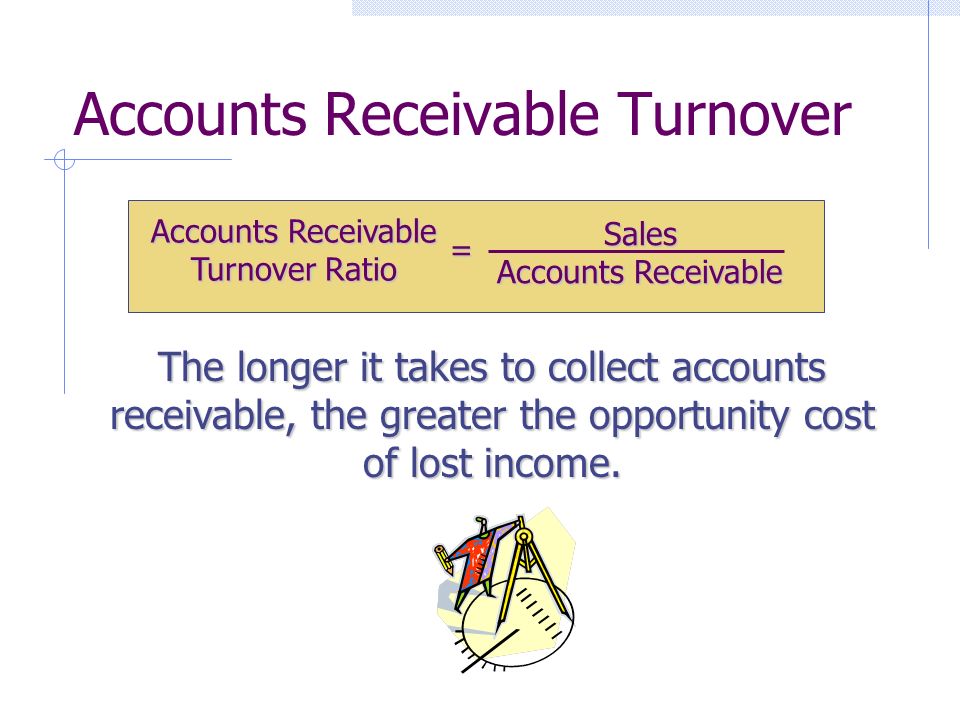

The accounts receivables turnover ratio measures the number of times a company collects its average accounts receivable balance. It is a quantification of a company’s effectiveness in collecting outstanding balances from clients and managing its line of credit process. Accounts receivable turnover ratio is calculated by dividing your net credit sales by your average accounts receivable. The ratio is used to measure how effective a company is at extending credits and collecting debts. Generally, the higher the accounts receivable turnover ratio, the more efficient your business is at collecting credit from your customers. Your accounts receivable turnover ratio measures your company’s ability to issue credit to customers and collect funds on time.

In some ways the receivables turnover ratio can be viewed as a liquidity ratio as well. Companies are more liquid the faster they can covert their receivables into cash. Alpha Lumber should also take a look at its collection staff and procedures.

By understanding this ratio, you can gain insights into a company’s effectiveness in using its assets to drive sales. Receivables turnover ratio (also known as debtors turnover ratio) is an activity ratio which measures how many times, on average, an entity collects its trade receivables during a selected period of time. It is computed by dividing the entity’s net credit sales by its average receivables for the period.

This article will explain to you the receivables turnover ratio definition and how to calculate receivables turnover ratio using the accounts receivable turnover ratio formula. Additionally, you will learn what does a high or low turnover ratio mean, and what are the consequences of each. Once you have your net credit sales, the second part of the accounts receivable turnover ratio formula requires your average accounts receivable. Centerfield Sporting Goods specifies in their payment terms that customers must pay within 30 days of a sale. Their lower accounts receivable turnover ratio indicates it may be time to work on their collections procedures. In doing so, they can reduce the number of days it takes to collect payments and encourage more customers to pay on time.

With Bench at your side, you’ll have the meticulous books, financial statements, and data you’ll need to play the long game with your business. Even if you trust the businesses that you extend credit to, there are other reasons you may want to make a more serious effort to develop a higher ratio. Our team is ready to learn about your business and guide you to the right solution. Bench simplifies your small business accounting by combining intuitive software that automates the busywork with real, professional human support.

A low asset turnover ratio indicates that the company is using its assets inefficiently to generate sales. The accounts receivables turnover metric is most practical when compared to a company’s nearest competitors in order to determine if the company is on par with the industry average or not. On the balance sheet, accounts receivable (A/R) represents the unmet payment obligations by customers, so the quick retrieval of owed cash payments implies the company can efficiently manage the credit extended to customers. The Accounts Receivable Turnover is a working capital ratio used to estimate the number of times per year a company collects cash payments owed from customers who had paid using credit. Average accounts receivables is the money from previous credit sales that the business has yet receive from customers.

Commentaires récents