Fixed costs do not vary with the volume of sales, whereas variable costs vary directly with sales volume. In fact, the relationship between sales revenue and EBIT is referred to as operating leverage because when the sales level increases or decreases, EBIT also changes. Variable costs decreased from $20mm to $13mm, in-line with the decline in revenue, yet the impact it has on the operating margin is minimal relative to the largest fixed cost outflow (the $100mm). From Year 1 to Year 5, the operating margin of our example company fell from 40.0% to a mere 13.8%, which is attributable to $100 million fixed costs per year. In our example, we are going to assess a company with a high DOL under three different scenarios of units sold (the sales volume metric).

Operating leverage vs. financial leverage

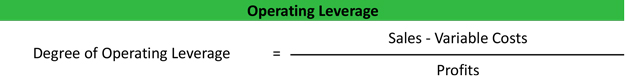

However, in DOL, the derived proportion of sales only works with a limited range, which may become a problem. If sales increase beyond this limit, a business may increase its production resulting in a rise in the fixed cost structure. By breaking down the equation, you can see that DOL is expressed by the relationship between quantity, price and variable cost per unit to fixed costs. If operating income is sensitive to changes in the pricing structure and sales, the firm is expected to generate a high DOL and vice versa. Use this calculator to easily determine the Degree of Operating Leverage (DOL) for your business. Simply input the values for sales, fixed costs, and variable costs to get the result.

What Are the Differences Between Operating Leverage and Financial Leverage?

- With the right tools and understanding, you can leverage your fixed costs to drive financial success.

- For the particular case of the financial one, our handy return of invested capital calculator can measure its influence on the business returns.

- The DOL ratio helps analysts determine what the impact of any change in sales will be on the company’s earnings.

- As a hypothetical example, say Company X has $500,000 in sales in year one and $600,000 in sales in year two.

- The higher the DOL is, the more sensitive the company’s EBIT is to changes in sales.

This section will use the financial data from a real company and put it into our what is cloud computing everything you need to know. Financial and operating leverage are two of the most critical leverages for a business. Besides, they are related because earnings from operations can be boosted by financing; meanwhile, debt will eventually be paid back by those increased earnings. Once obtained, the way to interpret it is by finding out how many times EBIT will be higher or lower as sales will increase or decrease respectively. For example, for an operating leverage factor equal to 5, it means that if sales increase by 10%, EBIT will increase by 50%. To determine whether your business has a high or a low DOL, examine your organisation’s performance compared to other organisations.

How Can This Metric Help You Make Better Decisions?

Upon multiplying the $2.50 cost per unit by the 10mm units sold, we get $25mm as the variable cost. However, companies rarely disclose an in-depth breakdown of their variable and fixed costs, which makes usage of this formula less feasible unless confidential internal company data is accessible. On that note, the formula is thereby measuring the sensitivity of a company’s operating income based on the change in revenue (“top-line”). The DOL measures the how sensitive operating income (or EBIT) is to a change in sales revenue. Degree of combined leverage measures a company’s sensitivity of net income to sales changes.

A company with a high DCL is more risky because small changes in sales can have a large impact on EPS. It is therefore important to consider both DOL and financial leverage when assessing a company’s risk. If the company’s sales increase by 10%, from $1,000 to $1,100, then its operating income will increase by 10%, from $100 to $110. However, if sales fall by 10%, from $1,000 to $900, then operating income will also fall by 10%, from $100 to $90.

Unit Converter ▲

This guide will walk you through the ins and outs of using the Degree of Operating Leverage Calculator, all while keeping things engaging and lighthearted. We put this example on purpose because it shows us the worst and most confusing scenario for the operating leverage ratio. The Degree of Operating Leverage is also important for an investor, as it can indicate the risk of an investment and illustrates the performance of a company. Read on to learn how to calculate DOL and how different it is from financial leverage.

Conversely, if sales decline, the company still needs to cover substantial fixed costs, which can significantly hurt profitability. The Degree of Operating Leverage (DOL) measures how a company’s operating income responds to changes in sales. It provides insight into the relationship between fixed and variable costs and their impact on profitability. High DOL indicates that a small percentage change in sales can lead to a significant change in operating income. Managers use operating leverage to calculate a firm’s breakeven point and estimate the effectiveness of pricing structure. An effective pricing structure can lead to higher economic gains because the firm can essentially control demand by offering a better product at a lower price.

However, if revenue declines, the leverage can end up being detrimental to the margins of the company because the company is restricted in its ability to implement potential cost-cutting measures. Or, if revenue fell by 10%, then that would result in a 20.0% decrease in operating income. Variable costs vary with production levels, such as raw materials and labor. Fixed costs remain constant regardless of production levels, such as rent and insurance.

However, you should not be referring to every industry as some might have higher fixed costs than other industries. Degree of operating leverage, or DOL, is a ratio designed to measure a company’s sensitivity of EBIT to changes in revenue. For instance, a 10% increase in sales for a company with low DOL might result in a less than 10% increase in EBIT, indicating a more stable, albeit less responsive, profit scenario.

Commentaires récents